The dangers of credit card debt and strategies to avoid financial traps

Understanding Credit Card Debt

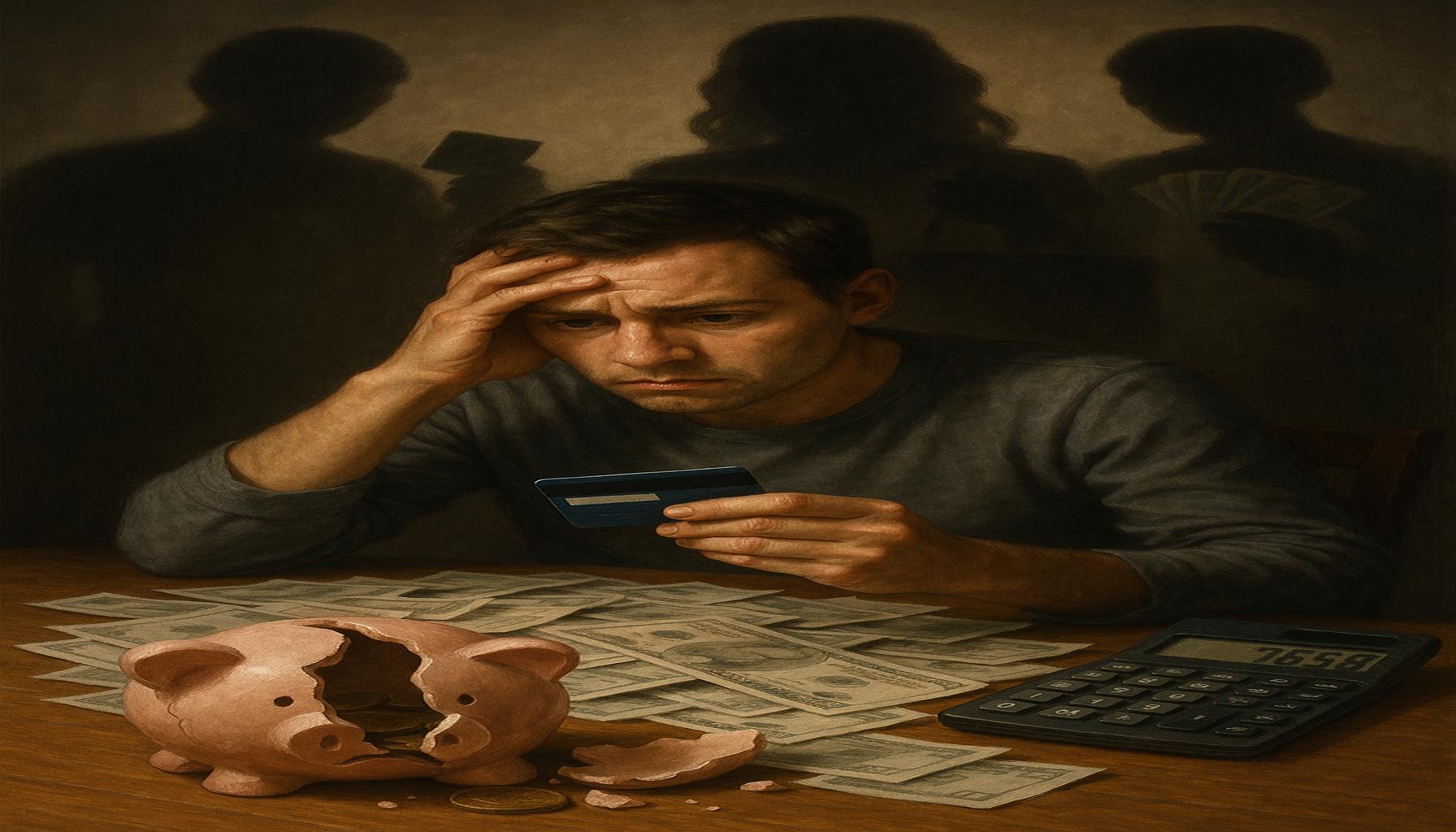

Credit card debt can be an insidious financial trap. Many consumers find themselves lured in by promotional interest rates and enticing rewards programs. These offers can seem too good to pass up, especially when a card promises points for travel or cashback on purchases. However, the allure often fades as monthly balances grow and high interest kicks in, turning what seemed like a financially savvy decision into a burden.

The Reality of Credit Card Debt

In the United States, the average household carries over $8,000 in credit card debt, a figure that can accumulate significant interest each month. For instance, if you maintain just a $5,000 balance on a card with a 20% annual percentage rate (APR), you may find yourself paying as much as $1,000 in interest over the course of a year if you make only minimum payments. This can lead to a vicious cycle of borrowing and repayment, leaving little room for financial growth or saving towards larger goals such as homeownership or retirement.

- High-Interest Rates: Many credit cards charge interest rates over 20%, drastically increasing total repayment amounts. It’s important to note that even a small difference in APR can have a significant impact on the overall cost of borrowing. For instance, at 15% interest, the same $5,000 balance would accrue only around $750 in interest over a year, making a noticeable difference in your financial situation.

- Minimum Payments: Only paying the minimum can extend debt repayment by years and increase total interest paid. If a card requires a minimum payment of 3% of the balance, paying this amount can result in decades of repayment, as interest accrues on the unpaid balance. For example, a $10,000 debt at 20% APR could take over 20 years to pay off if you manage to pay only the minimum.

- Impact on Credit Score: High credit utilization negatively affects credit scores, making it harder to secure loans or mortgages. Credit scoring models often penalize consumers whose credit cards are maxed out or used excessively, implying greater financial risk to lenders.

Strategies to Avoid Financial Traps

Understanding the dangers of credit card debt is crucial for maintaining financial health. Here are some practical strategies to avoid falling into debt traps:

- Budgeting: Create a detailed budget to track expenses and avoid overspending. By allocating a specific amount to each spending category, individuals can prioritize essential expenses and minimize unnecessary purchases. Tools like budgeting apps can help maintain clarity and discipline.

- Emergency Fund: Establishing an emergency fund can prevent reliance on credit cards for unexpected expenses. Ideally, this fund should cover three to six months of living expenses, offering financial security in times of need without resorting to high-interest credit options.

- Pay More Than the Minimum: Aim to pay more than the minimum payment to reduce interest accumulation. Even increasing your monthly payment by just $20 can significantly cut down the time it takes to pay off a balance and the total interest paid over time.

By implementing these strategies, consumers can safeguard their financial future and avoid the pitfalls of credit card debt. Maintaining awareness and exercising discipline in spending habits will undoubtedly lead to a healthier financial lifestyle. The objective should always be to avoid becoming trapped in debt, prioritize savings, and work towards achieving financial independence.

DISCOVER MORE: Click here for your guide to minimal living

The Hidden Costs of Credit Card Debt

The consequences of falling into credit card debt can extend far beyond the initial interest charges. For many individuals, monthly payments can easily become a burden that hinders their financial growth. Aside from high-interest rates, various fees can inflate debt quickly. Annual fees, late payment fees, and foreign transaction fees are just a few examples of costs associated with credit card usage that can accumulate over time, leading to a dangerous cycle of debt that feels nearly impossible to escape.

The Financial Impact of Credit Card Debt

To fully understand the dangers of credit card debt, it’s essential to explore its potential financial repercussions. The compounding nature of interest can lead to astonishing sums if not managed properly. Consider this: if an individual carries a balance of $10,000 at a 22% APR and pays only the minimum payment of 2% of the balance, they could remain in debt for over 23 years, paying nearly $17,000 in total. This staggering figure illustrates the importance of making informed financial decisions.

- Accumulation of Debt: Credit cards allow consumers to borrow funds, but this can lead individuals to spend beyond their means. When balances are allowed to accumulate unchecked, the debt becomes larger and harder to manage. A common mistake is treating credit as ‘extra’ income, which can quickly spiral out of control, particularly during emergencies or unplanned expenses.

- Stress and Emotional Impact: The burden of credit card debt is not solely a financial issue. Many experience significant stress and anxiety related to debt management. In fact, a study conducted by the American Psychological Association revealed that financial issues, including credit card debt, are major sources of stress for many Americans. This stress can lead to negative health outcomes and deteriorate personal relationships.

- Decreased Financial Opportunities: Consumers encumbered by high levels of credit card debt may find it challenging to qualify for important financial opportunities such as mortgages or auto loans. Lenders often review credit scores and credit utilization ratios. A high debt-to-income ratio resulting from excessive credit card debt can mark a borrower as high risk, limiting future financial options.

Recognizing these potential pitfalls is crucial for consumers who wish to maintain their financial stability and avoid falling into debt traps. Understanding the true costs associated with credit cards—both financial and emotional—can empower individuals to take charge of their financial situations. Building a robust strategy to manage or avoid credit card debt can pave the way for a more secure financial future.

DISCOVER MORE: Click here to learn about detachment

Strategies to Avoid Credit Card Debt

While the dangers of credit card debt are apparent, there are effective strategies consumers can implement to avoid falling into this financial trap. Being proactive about financial decisions can curtail the likelihood of incurring debt, thereby promoting healthier financial habits.

Create a Budget

One of the most fundamental and effective strategies for managing credit card use is creating a realistic budget. A budget serves as a financial roadmap that allows individuals to track income and expenses. Research by the National Endowment for Financial Education shows that those who stick to a budget are less likely to accumulate high credit card balances. By categorizing spending into essentials, discretionary expenses, and savings, consumers can allocate their resources more efficiently and stay within their means.

Emergency Fund

Establishing an emergency fund is another crucial facet of financial planning. This fund should ideally cover three to six months’ worth of living expenses, allowing individuals to navigate unforeseen circumstances without relying on credit cards. According to a Bankrate survey, 57% of Americans don’t have enough savings to cover a $1,000 emergency, making credit cards a tempting solution. By prioritizing savings, individuals can avoid the cycle of debt when life’s unexpected events occur.

Set Limits on Credit Card Use

Limiting credit card use can significantly lower the risk of accumulating debt. Consumers should aim to use credit cards only for planned purchases or expenses that can be paid off in full each month. This practice not only avoids interest charges but also promotes responsible spending habits. Setting a self-imposed limit, such as restricting credit card usage to a certain percentage of monthly income, can encourage more prudent financial decisions.

Regularly Review Financial Statements

Regularly examining credit card statements allows consumers to keep track of their spending habits and identify areas for improvement. An annual review of credit reports—available for free via AnnualCreditReport.com—enables individuals to spot discrepancies and potential fraud, which could lead to unauthorized debt. The Federal Trade Commission emphasizes the importance of monitoring credit reports as a means for maintaining financial health and preventing adverse financial consequences.

Consider Alternative Payment Methods

In some instances, consumers may benefit from considering alternative payment methods. Using debit cards, cash, or mobile payment apps can help avoid credit card debt entirely. These options limit spending to funds that are currently available, thus curtailing impulse purchases. Research shows that consumers often spend less when using cash compared to credit because they physically see the money leaving their hands, reinforcing the reality of their spending.

Develop Financial Literacy

Investing time in developing financial literacy can empower individuals to make informed decisions regarding credit cards and loans. Resources like financial courses, workshops, or literature from reputable sources can provide vital information on interest rates, fees, and debt management strategies. This knowledge equips consumers with the skills necessary to navigate the complexities of credit and avoid pitfalls associated with debt.

By employing these strategies, individuals can mitigate the risks of credit card debt and promote healthier financial practices. Taking charge of one’s financial situation is not only a safeguard against debt but also an investment in a more stable financial future.

DISCOVER MORE: Click here to start your minimalist journey

Conclusion

In navigating the financial landscape, the dangers associated with credit card debt present significant challenges for many consumers. As reliance on credit continues to escalate in the United States, understanding the potential pitfalls of accumulating debt is crucial for safeguarding one’s financial well-being. The alarming statistics indicate that a substantial portion of the population struggles with credit card debt, often leading to a cycle of financial stress, adversely affecting credit scores and increasing anxiety levels.

However, the implementation of well-structured strategies can serve as effective safeguards against these financial traps. Establishing a strong budget and creating an emergency fund can help cushion against unexpected expenses while promoting prudent spending habits. Moreover, adopting alternative payment methods not only encourages responsible financial behavior but also provides a tangible perspective on spending, which can mitigate the tendency to overspend.

Additionally, fostering financial literacy equips individuals with the tools necessary to make informed decisions about credit usage and debt management. By prioritizing education in financial principles, consumers can build a framework for sustainable financial practices that bolsters long-term stability.

Ultimately, the path to avoiding the pitfalls of credit card debt lies in proactive financial management and education. By implementing these strategies, individuals not only protect themselves from the immediate dangers of credit card debt but also set the foundation for a healthier financial future. Recognizing the importance of making informed choices is essential in a world where credit can either empower or ensnare. Choosing wisely can lead to financial freedom rather than financial bondage.

Related posts:

The Evolution of Credit Cards: From Plastic to Digital Wallets and Their Financial Implications

How to Apply for the Bank of America Travel Rewards Credit Card

How to Apply for Ally Platinum Mastercard Credit Card Easy Guide

How to Apply for Emirates Skywards Rewards World Elite Mastercard

How to Apply for the American Express Blue Cash Everyday Credit Card

How to Apply for Citizens Private Client World Elite Mastercard Credit Card

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the our platform. Her goal is to empower readers with practical advice and strategies for financial success.