Debt and Mental Health: How Financial Stress Affects Well-Being and How to Overcome It

The Impact of Financial Stress on Mental Health

In the modern economic landscape, financial stress has emerged as a significant contributor to mental health issues. More than half of American households report facing financial challenges, creating a ripple effect that could lead to anxiety, depression, and lowered overall well-being. The overwhelming nature of financial obligations can weigh heavily on an individual’s mental health, making understanding this relationship crucial for effective coping and recovery.

Statistics That Unveil the Reality

Startling statistics reveal the extent of financial-related anxiety among Americans:

- 70% of Americans report feeling stressed about their financial situation, indicating a widespread issue that transcends demographics.

- Approximately 1 in 5 Americans grappling with debt are also facing anxiety disorders, showing a clear correlation between financial burden and mental health struggles.

- Financial concerns directly impact professional life, as 36% of workers confess that their debt affects their job performance, which can lead to further financial instability if not managed properly.

The Broader Implications of Debt

Debt cannot merely be viewed as a financial issue; it carries profound implications for interpersonal relationships and personal health. Individuals facing significant financial challenges often report:

- Anxiety and panic attacks: Persistent worries about financial obligations can manifest as physical symptoms, leading to severe anxiety or panic disorders.

- Depression and feelings of hopelessness: The inability to see a way out of financial hardship can contribute to chronic feelings of sadness and despair, further exacerbating mental health challenges.

- Increased levels of frustration and irritability: Financial strain can induce a state of constant stress, leading to irritability that affects both personal and professional relationships.

Strategies for Coping with Financial Stress

Understanding the connection between financial stress and mental health opens the door for strategic actions. Individuals can empower themselves by actively managing their debt through various approaches. Establishing a budget is an essential first step; by tracking income and expenditures, individuals can identify where they can cut back on costs. Additionally, seeking financial counseling can provide tailored advice and support for those in overwhelming debt situations.

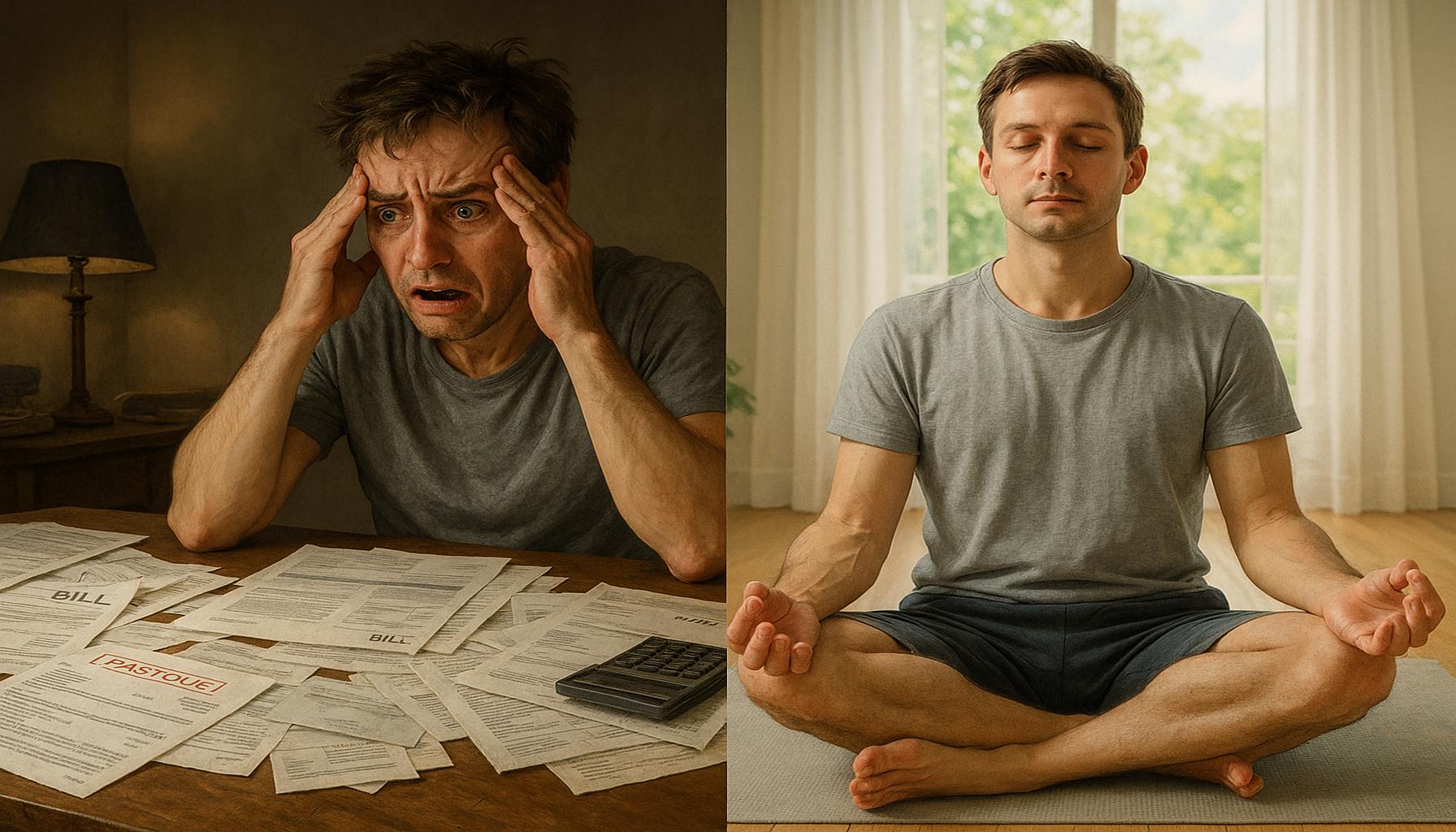

Moreover, engaging in mindfulness practices, such as meditation or yoga, can help mitigate the negative impacts of financial stress. By maintaining mental wellness, individuals can face their financial challenges with a clearer mindset, paving the way toward a more secure financial future.

In conclusion, recognizing the intricate relationship between financial stress and mental health is crucial for crafting effective coping strategies. By understanding and addressing the root causes of financial anxiety, individuals can work towards reclaiming their mental well-being and securing a brighter, more stable financial outlook.

DISCOVER MORE: Click here to learn how minimalism can transform your life

Understanding the Psychological Toll of Debt

Debt can be a mental health nightmare, transforming from a mere financial obstacle into a deeply ingrained emotional burden. The connection between financial stress and mental well-being is complex, with research increasingly supporting the notion that high levels of debt can lead to a range of mental health issues. Specifically, studies indicate that the strain of overwhelming debt can invoke feelings of isolation, inadequacy, and even lead to suicidal ideation in extreme cases.

The Cycle of Debt and Mental Illness

The relationship between debt and mental health can create a vicious cycle: financial strain exacerbates mental health issues, which in turn affects a person’s ability to manage their finances. This cycle can lead to:

- Increased absenteeism: Affected individuals may miss work due to mental health struggles, leading to reduced income and greater financial pressure.

- Social withdrawal: People dealing with debt often isolate themselves due to feelings of shame or embarrassment, which can further amplify feelings of hopelessness.

- Lowered self-esteem: The stigma of being in debt can make individuals feel inadequate, impacting their self-worth and introducing anxiety about future financial decisions.

Research conducted by the American Psychological Association found that 62% of adults report that finances are a source of stress in their lives. This statistic underscores that financial strain permeates various aspects of life, triggering a cascade of psychological ramifications.

Financial Stress: A Health Concern

Moreover, financial stress is not merely an emotional concern; it can lead to physical health problems as well. The stress hormone cortisol is released in higher quantities when individuals experience financial anxiety, leading to various health issues including high blood pressure, insomnia, and weakened immune systems. A study published in the Journal of Clinical Psychology indicated that individuals with high financial stress are more susceptible to chronic illnesses, thus demonstrating the pervasive impact that debt can exert on overall health.

In light of these findings, it is vital to acknowledge that our financial health cannot be separated from our mental and physical well-being. Understanding this connection is the first step towards recognizing the importance of addressing financial issues promptly. With more than 44 million Americans burdened by student loans alone and countless others grappling with credit card debt, there is an urgent need for effective support systems that bridge this gap.

The Importance of Seeking Help

In the face of overwhelming debt, seeking professional assistance should not be viewed as a failure but rather as a proactive step towards recovery. Financial therapists have emerged as essential resources, combining financial planning with emotional support to help individuals reclaim their mental health amidst financial distress. Their approach emphasizes holistic wellbeing, addressing the cognitive-behavioral aspects of financial problems while providing actionable steps for managing debt.

By breaking the silence around debt-induced mental health struggles, individuals can foster resilience and embark on a path toward recovery. Recognizing the psychological implications of debt is crucial, and it can provide individuals with the insight needed to take charge of their financial and mental wellness.

DISCOVER MORE: Click here to learn about the art of minimalism

Strategies for Managing Financial Stress

With the dual burden of debt and its impact on mental health well-established, it is crucial to explore effective strategies for managing both financial stress and overall well-being. A multi-faceted approach that combines financial education, emotional support, and practical budgeting skills can significantly reduce financial anxiety and restore a sense of control.

Financial Education and Literacy

Enhancing financial literacy is a vital tool in combating the negative feelings associated with debt. Research indicates that individuals who understand basic financial concepts, such as interest rates, compound interest, and effective debt management strategies, are less likely to experience anxiety over their finances. The National Endowment for Financial Education reports that participants in financial literacy programs show an increase in their ability to make sound financial decisions, resulting in less financial stress.

Online resources, books, and workshops can provide essential knowledge. For example, understanding how to consolidate credit card debt into a single lower-interest loan can not only save money but also simplify financial obligations. Additionally, budgeting tools like apps or spreadsheets empower individuals to track their expenses and income, helping to create a clearer financial picture. Those who actively engage in the budgeting process experience reduced feelings of helplessness, according to a study published in the Journal of Financial Therapy.

Mindfulness and Mental Health Support

Integrating mindfulness practices can be highly effective in alleviating stress associated with debt. Techniques such as meditation, yoga, and deep-breathing exercises have been shown to lower cortisol levels and promote overall mental well-being. The American Psychological Association notes that regular mindfulness practice can help individuals reframe their thinking about financial stress, shifting from feelings of despair to a more optimistic outlook.

Moreover, establishing a support system is essential. Engaging in open discussions about financial challenges with trusted friends or family members can help reduce feelings of isolation. Support groups or online forums focused on financial stress can also provide valuable communal support. According to the National Council on Problem Gambling, people who share their experiences in supportive environments tend to find it easier to manage their financial and emotional challenges.

Professional Guidance: Therapy and Counseling

When financial stress becomes overwhelming, it is crucial to recognize when professional help is necessary. Financial therapists can provide guidance tailored to both financial and emotional needs, allowing individuals to address underlying psychological issues as they tackle financial ones. According to a recent study by the Journal of Financial Counseling and Planning, individuals who worked with financial therapists reported improved mental health outcomes alongside better financial management.

Additionally, cognitive-behavioral therapy (CBT) is effective in altering negative financial thought patterns. This therapy has been proven to assist individuals in developing healthier perspectives towards debt and encourages constructive behavior change. Training in these therapeutic techniques has led many individuals to better cope with their financial obligations while simultaneously enhancing their mental resilience.

Developing Healthy Financial Behaviors

Creating and adhering to healthy financial habits is a key strategy in overcoming debt-related stress. Establishing automatic savings can cultivate a safety net, reducing anxiety about potential financial emergencies. Additionally, having a clear plan for debt repayment based on factors such as interest rates and payment deadlines provides individuals with tangible goals and a path to follow. According to the Consumer Financial Protection Bureau, those with structured repayment plans are significantly more likely to succeed in overcoming their financial burdens.

These various strategies—rooted in financial literacy, emotional support, and professional guidance—create a comprehensive approach that can help mitigate the mental health impact of debt. By actively engaging in these methods, individuals can not only work towards alleviating their financial burdens but also reclaim their mental health and overall well-being.

DIVE DEEPER: Click here to discover the advantages of minimalism

Conclusion

In summary, the interplay between debt and mental health is a significant concern that affects many individuals across the United States. Financial stress can lead to a plethora of emotional challenges, including anxiety, depression, and diminished self-esteem. Recognizing this relationship is the first step towards fostering resilience and well-being. The strategies outlined, from enhancing financial literacy to implementing mindfulness techniques, provide practical pathways to mitigate the impacts of financial stress.

Furthermore, seeking professional help, whether through financial coaching or therapy, can empower individuals to gain control over their circumstances. By understanding and addressing both the financial and emotional dimensions of their situation, individuals can work toward holistic recovery. Developing healthy financial habits that include structured repayment plans and savings strategies can create a fortified foundation, allowing individuals to feel more secure in their financial futures.

Importantly, tackling the stigma surrounding financial struggles and encouraging open conversations about debt can foster a supportive environment where individuals no longer feel isolated in their challenges. Ultimately, creating a balanced life that encompasses both financial stability and mental well-being is essential. With the right tools, support, and mindset, it’s entirely possible to overcome the challenges posed by debt and lead a fulfilling, stress-free life.

Related posts:

The Impact of Credit on Financial Life: How to Manage Debt and Improve Your Score

How to Save on Everyday Shopping: Practical Strategies for Saving

Comparison between Traditional Credit and Peer-to-Peer Credit: Advantages and Disadvantages

The Impact of Interest Rates on Personal Loans in the USA

Tips for Managing Your Personal Finances Using Budgeting Apps

How to Avoid Impulsive Spending Traps During Sales and Promotions

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the our platform. Her goal is to empower readers with practical advice and strategies for financial success.