How to Apply for NEO Credit Card Step-by-Step Guide Tips

The NEO Credit Card offers enticing benefits: earn cashback on every purchase, enjoy zero annual fees, access personalized spending insights, and benefit from robust security features. Flexible payment options ensure financial control, making it perfect for budget-savvy individuals looking to enhance their financial management.

How to Apply for an AMEX Business Platinum Card from American Express

The AMEX Business Platinum Card offers 5X points on booked travel, access to 1,400 lounges, and complimentary hotel perks. It includes business support with a 24/7 concierge and comprehensive travel insurance. Streamlined expense management tools simplify financial oversight, maximizing benefits for frequent business travelers.

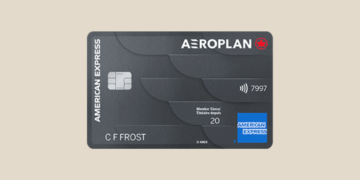

How to Apply for AMEX American Express Aeroplan Credit Card

The AMEX American Express Aeroplan Card allows you to earn Aeroplan points on all purchases, offers travel insurance coverage, and includes exclusive Air Canada perks like free checked bags. A generous welcome bonus accelerates point accumulation, making it perfect for frequent travelers seeking cost-efficient and rewarding experiences.

How to Apply for the National Bank Platinum Mastercard Credit Card

The National Bank Platinum Mastercard offers comprehensive travel insurance, a rewarding points program, purchase protection, and extended warranties on new items. Cardholders also enjoy exclusive dining and entertainment offers. These benefits enhance peace of mind and lifestyle, making this card a valuable companion for your spending needs.

The Art of Negotiating: How to Get Discounts and Save Money on Everyday Purchases

Negotiation skills can significantly enhance your financial wellness by enabling you to secure discounts on everyday purchases. By applying strategies such as comparison shopping and building rapport with sellers, you can transform routine transactions into opportunities for savings and enrich your overall shopping experience.

The Importance of Financial Education in Household Economy: Tips for Conscious Saving

In today's complex financial landscape, enhancing financial education is essential for households. By mastering budgeting, leveraging technology, and understanding investment principles, families can adopt conscious saving habits. This empowers them to achieve financial stability and fosters a culture of accountability, securing a prosperous future for generations to come.

Using Technology to Track Expenses and Optimize Personal Finance

Explore how financial technology empowers Canadians to track expenses and optimize personal finance effectively. By leveraging budgeting apps, expense tracking software, and automated banking features, individuals can gain insights into their spending habits, enhance financial decisions, and cultivate a disciplined approach to budgeting for long-term financial success.

Strategies to Maximize Rewards and Minimize Interest on Credit Cards

Navigating credit cards effectively involves selecting the right card, paying balances in full, and maximizing rewards through strategic spending. Utilizing promotional offers and advanced features can enhance benefits while minimizing interest rates, empowering users to achieve financial stability and optimize their credit card experience.

The Impact of Credit Cards on the Financial Health of Young Adults

Credit cards can significantly influence the financial health of young adults by offering convenience and opportunities for building credit history. While they provide rewards and act as safety nets for emergencies, mismanagement can lead to debt accumulation and financial stress. Understanding the risks is crucial for fostering responsible credit habits.

How to Choose the Ideal Credit Card for Your Needs

Choosing the right credit card is essential for maximizing financial benefits. Understanding various credit card types, interest rates, and fees can guide you to a card that aligns with your spending habits. Assessing rewards, introductory offers, and issuer reputation enhances your overall credit experience, contributing to better financial management.