Budgeting Strategies: How to Create a Financial Plan that Works

Understanding the Essentials of Effective Budgeting

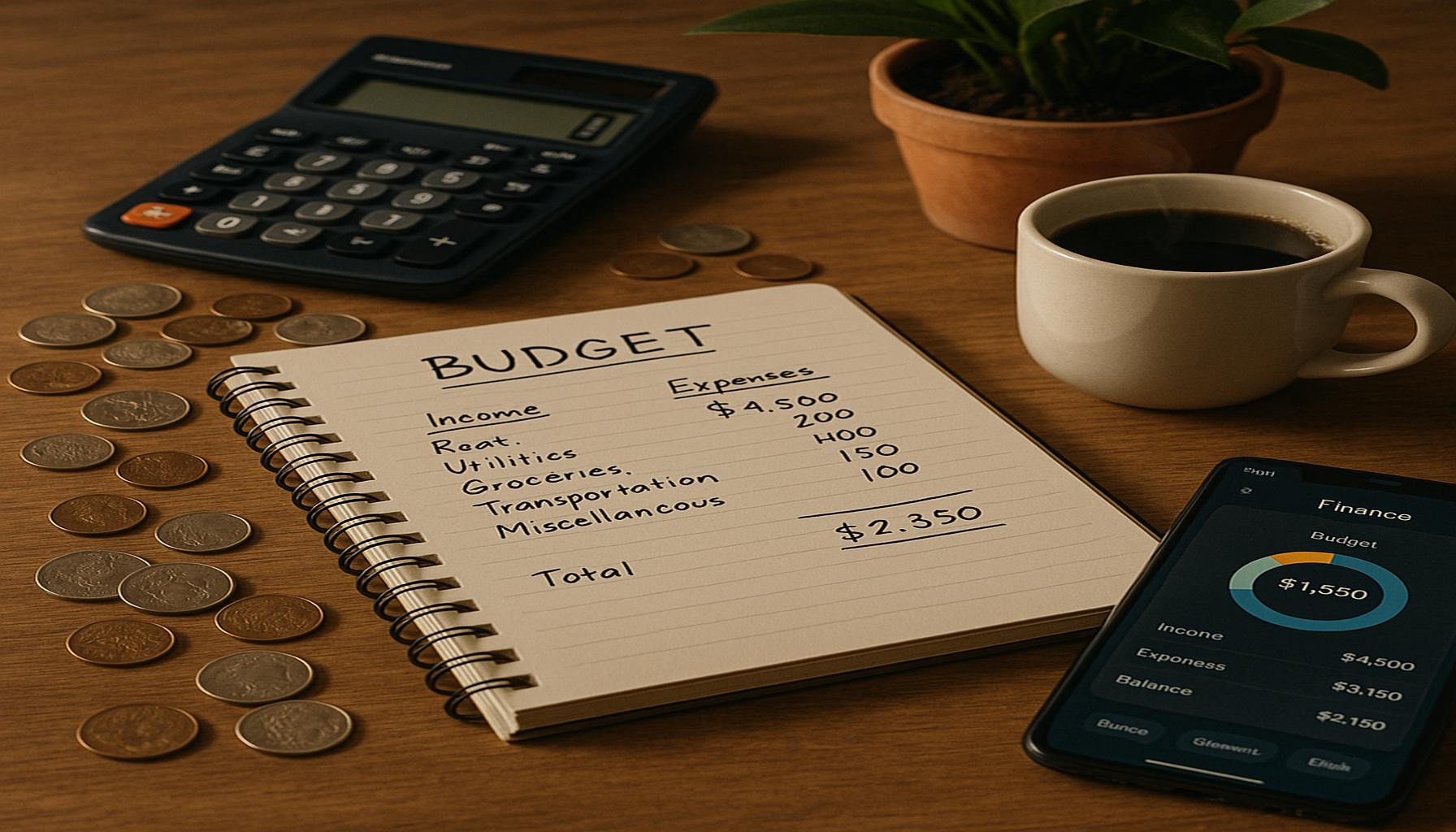

Effective budgeting is a cornerstone of financial management in today’s economy, playing a pivotal role in achieving both short-term financial stability and long-term financial goals. Whether you’re a recent college graduate entering the workforce or a seasoned professional planning for retirement, a well-designed financial plan is indispensable. This allows individuals to not just manage their current expenses but also to identify avenues for savings and future investments.

To create a successful financial plan, several critical components must be considered:

- Income Assessment: Begin by calculating all your sources of income. This includes your main salary, any side gigs like freelance work, and even passive income streams such as rental properties or dividends from investments. For example, if you earn $3,500 monthly from your job, make an additional $500 from tutoring, and receive $200 in dividend payments, your total monthly income stands at $4,200. Understanding your total income establishes a solid foundation for your budget.

- Expense Tracking: It is vital to monitor your monthly expenses thoroughly. Categorizing your costs into fixed expenses (like rent, mortgage, and insurance) and variable costs (like groceries and entertainment) allows for a better grasp of your spending behavior. For example, if you usually spend $300 on groceries but find that this amount fluctuates based on your shopping habits, you can adjust your budget accordingly to align spending with your financial goals.

- Goal Setting: Clearly defining short-term and long-term financial goals is essential. Short-term goals may include saving for a vacation or building an emergency fund, whereas long-term goals could involve saving for a house or retirement. Setting SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals can significantly enhance your financial focus and accountability.

Furthermore, implementing effective budgeting strategies can profoundly impact your financial health. Below are some popular methods:

- Zero-Based Budgeting: This strategy involves allocating every dollar of your income to specific categories such as expenses, savings, or debt repayments. It requires discipline but ensures that your budget is balanced at the end of each month. For instance, if you receive $4,200 in income and assign $1,200 for savings, $2,000 for expenses, and $1,000 for debt repayments, you can see exactly where your money goes.

- The 50/30/20 Rule: A popular budgeting method is to spend 50% of your income on needs, 30% on wants, and save 20%. For someone earning $4,200 monthly, it would mean spending $2,100 on needs (like housing and groceries), $1,260 on wants (such as dining out and entertainment), and saving $840. This rule encourages a balanced approach to spending and saving.

- Envelope System: For those who prefer a more tangible method, the envelope system involves using cash for different spending categories. By visually separating funds, you limit overspending. For example, if you allocate $400 for dining out in cash, once that envelope is empty, you cannot spend more in that category for the month.

By diligently implementing these strategies, you not only position yourself to create a robust financial plan but also develop a lifestyle that prioritizes financial literacy and responsibility. Comprehensive understanding of these principles is essential for navigating the complexities of personal finance, allowing you to secure a more stable financial future.

DISCOVER MORE: Click here to learn how minimal living can boost your mental health

Identifying Your Financial Landscape

Before diving into specific budgeting strategies, it is essential to have a clear understanding of your financial landscape. This involves not just knowing how much you make and spend but also grasping the nuances of your financial situation. A comprehensive evaluation allows for informed decision-making and a tailored approach to budgeting.

To effectively outline your financial landscape, consider the following critical elements:

- Net Worth Calculation: Start by determining your net worth, which is calculated by subtracting your total liabilities from your total assets. For instance, if you own a home valued at $300,000 and have $50,000 in debt (including mortgages, car loans, and credit card balances), your net worth would amount to $250,000. This figure provides a snapshot of your overall financial health and helps set realistic financial goals.

- Debt Analysis: Understanding the various categories of debt you hold, along with their interest rates, is critical for effective budgeting. Segment your debt into secured debts (like mortgages and auto loans) and unsecured debts (like credit cards and personal loans). Analyzing your debt enables you to prioritize repayments more effectively. For instance, if you have a credit card debt with an interest rate of 18% and a student loan with a 5% rate, focusing on paying off the credit card first can save you a significant amount in interest over time.

- Savings and Investments Overview: Examine your existing savings accounts and investment portfolios to better understand your financial position and growth potential. Consider the allocation between your emergency fund, retirement accounts, and other investment vehicles. Research shows that maintaining three to six months’ worth of living expenses in an emergency fund is crucial for financial security. If your monthly expenses total $3,000, aim for an emergency fund ranging between $9,000 and $18,000.

- Insurance Coverage: Don’t overlook the importance of insurance as part of your financial strategy. Review your health, property, and life insurance policies to ensure that you’re adequately covered against unforeseen events. Proper coverage can prevent financial devastation in the wake of emergencies and enable you to focus on your budgeting goals.

An in-depth analysis of your financial landscape sets the stage for creating a financial plan that works. With a clear picture of your income, expenditure, net worth, debts, savings, and insurance, you can move confidently into the actual budgeting phase.

Crafting the Budgeting Framework

With a solid understanding of your fiscal situation, the next step is to develop a budgeting framework that reflects your unique financial reality. This framework should seamlessly integrate your spending habits, financial goals, and lifestyle choices. A well-crafted budget not only serves as a roadmap for financial decisions but also provides insights into your spending behavior, ultimately leading to improved financial health.

When crafting your budget, consider utilizing a structured approach, combining various budgeting strategies to find what aligns best with your financial needs. Here are some effective tactics:

- Create a Detailed Spending Plan: Break down your monthly expenses into specific categories and set limits for each. Doing this can help in identifying unnecessary expenditures and areas for potential savings. If you discover that you routinely overspend on dining out, consider setting a strict limit of $150 per month as a potential adjustment.

- Automate Savings: Automating your savings can help ensure you’re consistently setting money aside. Set up automatic transfers to your savings account or retirement fund each month, ensuring you prioritize savings off the top of your income. If you earn $4,200 a month and aim to save $840, consider automatically transferring $280 every pay period.

- Regularly Review and Adjust: Your financial situation isn’t static, and neither should your budget be. Commit to reviewing your budget periodically—preferably monthly—to assess whether you’re meeting your goals and making necessary adjustments based on any changes in income or expenses.

By establishing a flexible yet structured budgeting framework, you’re better positioned to achieve your financial ambitions while adapting to any shifts in your financial landscape.

DISCOVER: Click here to enhance your space and mind

Implementing Effective Budgeting Techniques

Once you’ve established your budgeting framework, the next vital step is to implement effective techniques that align with your financial objectives. Employing these strategies can further refine your approach to managing your personal finances while ensuring that you stay on track to meet your goals.

Here are several proven budgeting techniques to consider:

- The 50/30/20 Rule: This popular budgeting method divides your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. Needs include essentials such as housing, utilities, and groceries, while wants cover discretionary expenses like dining out and entertainment. This method serves as a simple guideline to maintain balance in your financial life, allowing for both responsible saving and enjoyment of life’s pleasures.

- Zero-Based Budgeting: Unlike traditional budgeting methods, zero-based budgeting requires you to allocate every dollar of your income until there is no money left unassigned. This technique encourages meticulous tracking of expenses, as every dollar serves a specific purpose, whether it’s covering bills, going into savings, or paying down debt. A 2017 survey found that individuals who followed a zero-based budget reported higher satisfaction in managing their finances due to the enhanced clarity it brings.

- Envelope System: This cash-based budgeting strategy utilizes physical envelopes to help manage spending in specific categories. For instance, if you allocate $200 for groceries, you’d place that money in a designated envelope. Once the envelope is empty, no further spending in that category is allowed for the month. This tactile approach often helps curb overspending, especially in discretionary categories where it’s easy to lose track of expenditures.

- Time-Based Budgeting: Adjusting your budget based on time periods, such as weekly or biweekly, can make your budgeting more manageable and relevant. For instance, setting a weekly grocery budget instead of a monthly one allows for frequent reassessment of spending habits and encourages more immediate adjustments to keep your budget on track.

- Utilize Budgeting Apps and Tools: In the digital age, leveraging technology can simplify the budgeting process. Apps like Mint, YNAB (You Need A Budget), and Personal Capital offer user-friendly interfaces to help track expenses, categorize spending, and visualize financial data. These tools can provide alerts for overspending, goals tracking, and even investment tracking, providing a comprehensive view of your financial health.

Moreover, integrating some of these techniques can lead to enhanced financial discipline. For example, combining the 50/30/20 rule with the envelope system provides a dual-layered approach where you can maintain an eye on overall financial structure while also managing immediate cash flow effectively.

Another essential aspect to consider while implementing these strategies is the necessity of emotional awareness. Understanding your spending triggers—such as emotional spending, lifestyle inflation, or peer pressure—can enhance your commitment to staying within budget. Research indicates that psychological factors significantly influence spending habits, so developing emotional intelligence regarding finances is crucial in resisting impulsive purchases and adhering to your budget.

Implementing these effective budgeting techniques is foundational to creating a sustainable financial plan that resonates with your aspirations and lifestyle. By maintaining flexibility and reviewing your strategies regularly, you create a dynamic budgeting experience that adjusts to life’s changes while keeping your financial goals in clear focus.

DISCOVER MORE: Click here to simplify your life

Conclusion

In conclusion, mastering budgeting strategies is essential for anyone looking to create a financial plan that not only succeeds but also thrives amidst the complexities of modern living. By understanding your financial landscape and utilizing methods such as the 50/30/20 Rule, Zero-Based Budgeting, and the Envelope System, you can create a personalized approach that aligns with your unique needs and goals. Each technique offers distinct advantages, allowing you to choose the one or combination that best suits your circumstances.

Furthermore, emotional awareness is a crucial component that often gets overlooked. Recognizing your spending triggers and developing emotional intelligence regarding your financial habits can significantly enhance your budgeting efforts. The psychological factors at play can lead to either financial success or pitfalls, making it vital to remain vigilant and reflective.

As you adopt these strategies, remember that progress is not always linear; adjust your approach as needed. Regular reviews of your budget will provide insights into your spending patterns and allow for timely adjustments. By implementing an adaptive budgeting plan, you not only cultivate financial discipline but also give yourself the freedom to enjoy life’s experiences without the weight of financial stress.

Ultimately, the journey to effective budgeting is ongoing. It requires persistence, a willingness to learn, and the ability to modify your strategies as your financial landscape evolves. By committing to these principles, you can pave the way for a secure and financially fulfilling future.

Related posts:

Using Personal Finance Apps to Efficiently Monitor and Manage Debt

Student Debt: Strategies to Manage and Reduce Financial Impact

The Importance of Technology in Personal Finance: Apps that Help Save

The Importance of Creating an Emergency Fund to Avoid New Debts

Effective Strategies for Negotiating Debts with Creditors

Creating a Sustainable Budget to Settle Debts Sooner

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the our platform. Her goal is to empower readers with practical advice and strategies for financial success.