How to Avoid Impulsive Spending Traps During Sales and Promotions

Understanding Impulsive Spending

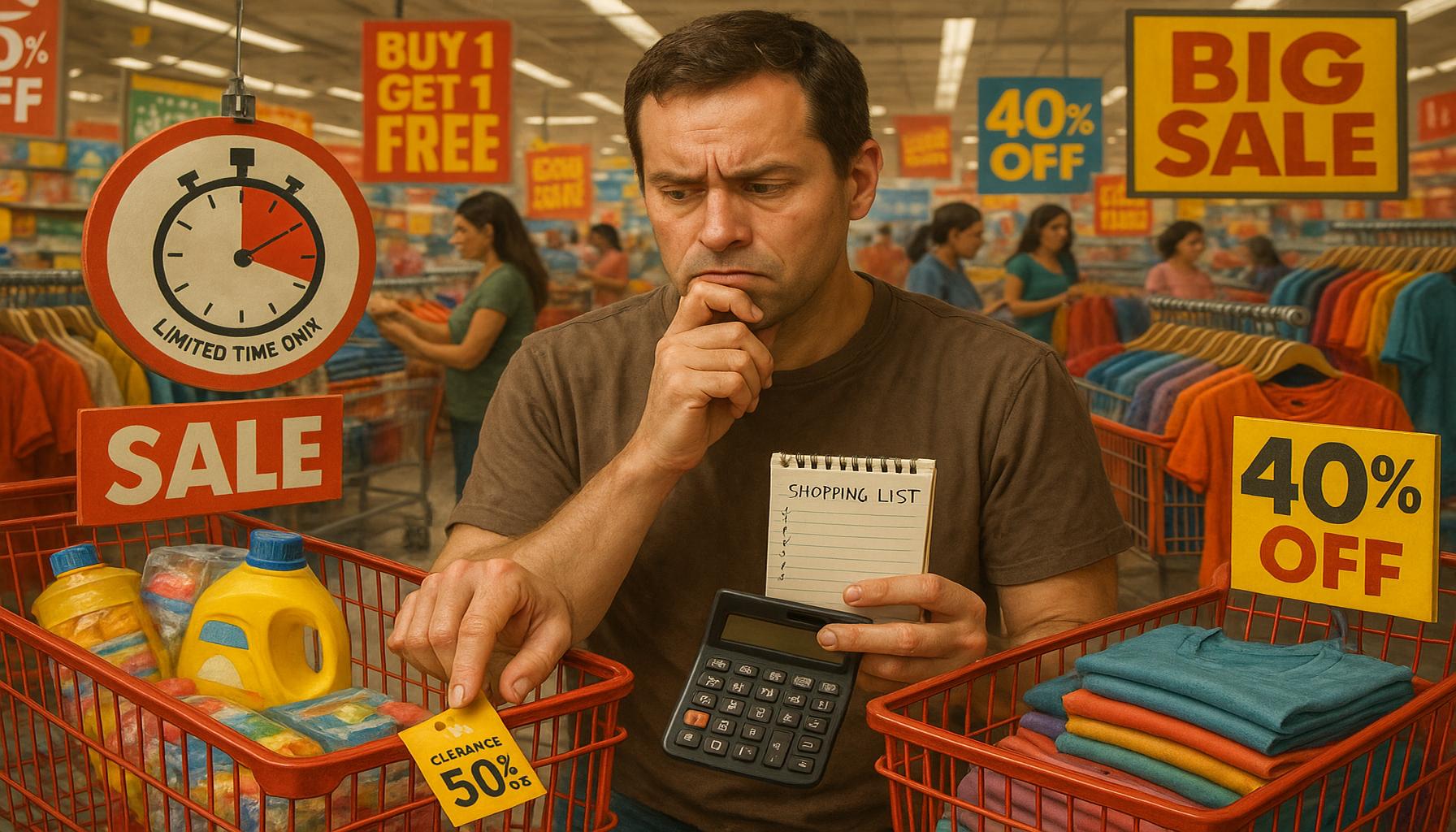

In an age where consumerism thrives, the allure of sales and promotions often tempts individuals into impulsive spending, potentially jeopardizing their carefully laid financial plans. The prevalence of eye-catching advertisements, blinking discount tags, and enticing limited-time offers can trigger overwhelming emotions, leading to hasty decisions. Recognizing these psychological triggers is crucial in safeguarding against regretful purchases, saving money, and maintaining a balanced budget.

The Psychology of Retail Promotions

- Fear of Missing Out (FOMO): The concept of FOMO is particularly potent during promotional events. Retailers frequently employ scarcity tactics, such as displaying a countdown timer or indicating limited stock availability, which can exacerbate anxiety over potentially missing out on a desirable item at a great price. For instance, when a clothing store advertises a 50% off sale for only 48 hours, consumers may feel compelled to buy clothing they neither need nor were initially interested in, simply to avoid regret.

- Social Influence: The power of social proof can also lead to overspending. When friends or influencers flaunt their recent purchases on social media, it can spark feelings of inadequacy or the desire to keep up with peers. Viewing friends flaunt new tech gadgets or fashion items may prompt individuals to make rushed purchases to fit into social circles, further perpetuating the cycle of impulsive buying.

- Emotional Triggers: Shopping can serve as a temporary escape from stress or boredom, often leading individuals to make unnecessary purchases. For example, someone dealing with a tough day at work might resort to buying new shoes online as a way to uplift their spirits. This behavior not only strains personal finances but may also lead to buyer’s remorse once the initial thrill fades.

Research indicates that approximately 60% of shoppers confess to making impulse purchases, especially during promotional events like Black Friday or seasonal clearances. This statistic emphasizes the prevalence of impulsive spending, making it clear that a structured approach to shopping is essential in today’s retail landscape.

To combat the pervasive nature of impulsive purchases, developing a personal spending strategy can be tremendously effective. Here are some foundational techniques to consider:

- Establish a Budget: Begin by designating specific monetary amounts you are willing to spend during sales. This can not only enhance self-discipline but also allow for some enjoyment without financial compromise.

- Make a Shopping List: Before heading out or browsing online, create a list of items that you truly need. By sticking to this list, you can avoid the temptation to purchase extra items.

- Delay Purchases: It can be beneficial to implement a cooling-off period. Allowing yourself 24 hours or longer to reconsider a purchase can lead to more informed decision-making. Many times, the initial excitement fades, leading to a realization that the item may not be necessary after all.

By equipping yourself with knowledge and a clear set of strategies, navigating through sales seasons can become a more disciplined process. Implementing these measures will not only help to mitigate impulsive spending but will also pave the way towards achieving financial stability and personal goals.

DISCOVER MORE: Click here to unlock the benefits of minimalism

Strategies for Mindful Spending

Implementing practical strategies can significantly reduce the likelihood of falling into impulsive spending traps during sales and promotions. By establishing a controlled approach to shopping, individuals can enjoy the benefits of discounts while preserving their financial well-being. Below are several effective strategies to consider:

- Set Clear Financial Goals: Before participating in any sale, take the time to establish clear financial goals, such as saving for a vacation or paying off debt. By having tangible objectives in mind, individuals are less likely to stray from their spending limits during promotional events. According to a survey conducted by the National Endowment for Financial Education, individuals who set financial goals are 50% more likely to stick to their budgets compared to those who do not.

- Utilize Price Comparison Tools: In the digital age, finding the best deals has never been easier. Use price comparison tools or apps that allow for quick evaluations of product prices across different retailers. Research indicates that consumers who compare prices can save an average of 20-30% on their purchases. This simple step not only enhances financial awareness but also helps to differentiate between genuine savings and marketing hype.

- Limit Exposure to Advertising: Reducing exposure to advertisements can be an effective way to curb the impulse to spend. Unsubscribe from promotional emails and avoid browsing company websites unless there is a specific need. A study from the Journal of Consumer Research revealed that consumers who interact less with sales promotions are less likely to make unnecessary purchases. By limiting exposure, individuals can lessen the persuasive power of impulse-driven marketing.

- Set Up Alerts for Desired Products: Instead of succumbing to impulsive purchases, set up alerts for specific items you genuinely wish to buy. Many online retailers offer price drop notifications or wish lists. This approach allows consumers to wait for a suitable price while keeping their emotional purchasing triggers in check. This strategy not only aids in organized shopping but also reinforces discipline, as costs can often fluctuate significantly.

Incorporating these strategies into one’s shopping routine can enhance self-control and ensure more thoughtful financial decisions, especially during tempting sales periods. By remaining committed to a structured approach, shoppers can take advantage of discounts without sacrificing their financial futures.

Recognizing Triggers and Creating Accountability

Awareness of personal spending triggers often paves the way towards improved financial behavior. Whether it is emotional reliance on shopping for stress relief or social pressures to keep up with trends, acknowledging these patterns is crucial. Maintaining accountability, be it through a trusted friend or financial advisor, can help maintain focus on spending goals. A study by the American Psychological Association found that individuals who share their financial goals with others are significantly more likely to achieve them, thereby reinforcing the importance of outside accountability when combating impulsive spending.

These techniques, whether budget-focused or emotionally driven, are vital to navigate the complexities of sales and promotions effectively, allowing consumers to enjoy savings responsibly. By diligently applying these strategies and remaining vigilant, individuals can transform their shopping habits into a more sustainable and financially sound practice.

DIVE DEEPER: Click here to discover the journey of minimalism

Understanding the Psychology of Sales

To effectively combat impulsive spending during sales and promotions, it is essential to understand the psychological mechanisms that drive consumer behavior. Marketers often exploit cognitive biases and emotional triggers to create a sense of urgency and desire, leading consumers to make impulsive purchases. By recognizing these tactics, individuals can develop a heightened awareness and resistance to such influences.

The Scarcity Principle

One of the most common psychological tactics used in marketing is the scarcity principle. When consumers perceive that an item is in limited supply or available for a short time, they may feel an increased pressure to buy immediately. This urgency can cloud judgment and lead to unnecessary purchases. For instance, a common phrase like “limited time offer” or “only a few left in stock” can trigger an impulse buy driven by fear of missing out (FOMO).

To counteract this, it is essential to recognize that there will always be new sales and promotions. Delay purchasing decisions for at least 24 hours. This cooling-off period allows for a more rational evaluation of whether an item is genuinely needed and worth the expense. Research from the Journal of Marketing indicates that consumers who wait before purchasing are more likely to report satisfaction with their decision and less buyer’s remorse.

Understanding Retail Tricks

Retailers also employ various tricks to enhance product desirability. For example, using anchoring strategies, retailers often display high original prices alongside discounted rates, making the savings appear more significant. A study by the Harvard Business Review shows that consumers are more likely to buy items when they see a marked-down price, even if they weren’t initially interested in the product. Understanding this tactic can help consumers recognize when they are being manipulated and re-evaluate their spending choices.

Create a Shopping Plan

To prevent falling prey to such marketing techniques, creating a detailed shopping plan before any sale can be incredibly effective. Consider drafting a list that includes specific items you need and the amounts willing to spend on each. When you navigate a sale armed with this list, it can serve as a shield, protecting you from impulsive decisions driven by external factors.

Moreover, incorporating non-monetary rewards can be an effective motivator to solidify this disciplined approach. For example, noting a personal reward for sticking to your shopping plan, such as enjoying a favorite activity or saving up for a more significant purchase, can bolster self-control. Research from the Psychological Science journal indicates that external rewards can enhance goal adherence by making the process more enjoyable.

The Role of Emotional Intelligence

Finally, enhancing one’s emotional intelligence can play a pivotal role in curbing impulsive spending. Emotional intelligence involves recognizing emotional triggers and how they influence decision-making. By reflecting on moments of vulnerability—such as stress or boredom—consumers can identify patterns that lead to impulsive shopping behaviors.

Engaging in self-reflection and keeping a journal of feelings associated with shopping experiences can provide valuable insights. According to research from the University of California, tracking emotional responses and spending habits correlates with a 30% decrease in impulsive purchases. Developing emotional awareness can ultimately empower individuals to make more conscious and responsible financial decisions.

By understanding the nuances of psychological influences, recognizing retail tactics, and cultivating emotional intelligence, consumers can forge a more disciplined approach to shopping, particularly during sales and promotions. Implementing these strategies can significantly enhance overall financial health and well-being, paving the way for more mindful consumerism.

DIVE DEEPER: Click here to learn more about minimalism and sustainability

Conclusion

In today’s consumer-driven environment, navigating sales and promotions requires a well-thought-out strategy to avoid impulsive spending traps. As highlighted throughout this article, understanding the psychological mechanisms employed by retailers, such as the scarcity principle and anchoring strategies, equips consumers with the tools needed to make informed purchasing decisions. By cultivating emotional intelligence and engaging in self-reflection, individuals can recognize the emotional triggers that often lead to unnecessary purchases.

Additionally, developing a detailed shopping plan not only helps maintain focus on genuine needs but also encourages a disciplined approach to spending. The integration of non-monetary rewards can further enhance commitment to these plans, providing a holistic method to manage financial behavior effectively. Research indicates that individuals who approach shopping with awareness and intentionality are more likely to report satisfaction and reduced buyer’s remorse, validating the importance of these practices.

Ultimately, by practicing mindfulness and utilizing strategic thinking during sales and promotions, consumers can retain control over their financial situation. Rather than succumbing to the allure of discounts and time-limited offers, individuals have the power to prioritize responsible spending habits. This approach not only fosters personal financial well-being but also cultivates a culture of mindful consumerism, where purchases are made thoughtfully, aligning with one’s values and financial goals. With these strategies in hand, anyone can navigate the overwhelming landscape of promotions while maintaining financial integrity.

Related posts:

The Role of Financial Education in Preventing Debt and Credit Recovery

The Role of Community Banks in Financial Inclusion in the USA

Technological Innovations and the Future of Banking Services in the United States

Strategies for Managing Debt and Improving Credit Score in Times of Crisis

The Impact of Credit on Financial Life: How to Manage Debt and Improve Your Score

Comparison between Traditional Credit and Peer-to-Peer Credit: Advantages and Disadvantages

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the our platform. Her goal is to empower readers with practical advice and strategies for financial success.